28+ reverse mortgage for senior

With a reverse mortgage the amount of money you can borrow is based on how much equity you have in your. Ad Our Reviews and Recommendations Are Trusted By 45000000 Customers.

The New Math Of Reverse Mortgages For Retirees Wsj

Be at least 62 years old Have zero delinquencies on any federal debt Own your home free and clear or have 50.

. Web General reverse mortgage requirements include the following. Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today. Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly.

A reverse mortgage is a load given to people who are aged 62 or more with respect to their home equity. Web Reverse mortgages are an innovative way for seniors to fund their retirement by tapping into accrued home equity. Turn A Portion Of Your Homes Equity Into Supplemental Cash With A Reverse Mortgage Loan.

Ad Homeowners 62 older with at least 50 home equity may qualify for a reverse mortgage. Web Homeowners often refinance into a reverse mortgage but eligible seniors may also use a reverse mortgage to fund the purchase of a home. Web Reverse mortgages provide a way to add cash flow to a seniors budget.

Because for many seniors they dont actually need 100000 in a bank. Web A reverse mortgageis a type of loan for homeowners aged 62 and older. Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today.

Web A reverse mortgage is a type of loan that homeowners aged 62 and above can apply for. Web Current 30 year mortgage refinance rate moves up 022. Web Recent data from the National Reverse Mortgage Lenders Association NRMLA and the RiskSpan Reverse Mortgage Market Index shows that senior home.

Compare Our List Of Popular Reverse Mortgage Lending Companies Quickly and Easily. Web A reverse mortgage is a loan available to senior homeowners 62 years and older that allows them to convert part of the equity in their homes into payments from. Turn A Portion Of Your Homes Equity Into Supplemental Cash With A Reverse Mortgage Loan.

This form of loan allows borrowers to. Certain criteria must be met to. Web 1 day agoI think that for many seniors its a product that doesnt suit or doesnt fit their needs he said.

Web A reverse mortgage is a loan taken by senior citizens on the equity of their home loan that they will not pay back as long as the home is their principal residence. Tap into your home equity with no monthly mortgage payments with a reverse mortgage. Web A reverse mortgage is a loan taken out against the value of your home.

Instantly estimate your reverse mortgage loan amount with the Reverse Mortgage Calculator. No income is required to qualify. Web If youre 62 or older you might qualify for a reverse mortgage.

The average 30-year fixed-refinance rate is 713 percent up 22 basis points over the last week. Web If you are over the age of 62 and own your own home a reverse mortgage might be the perfect solution. Ad While there are numerous benefits to the product there are some drawbacks.

Seniors who still owe on their mortgages can refinance to a reverse mortgage and. To qualify for a reverse mortgage loan you need to have a sufficient amount of home. Learn About This Mainstream Movement.

Web What is a Reverse Mortgage Loan for Seniors. Ad AAG is Americas 1 Reverse Mortgage Provider Has Educated Over 1 Million Retirees. You can use the equity youve accumulated in your home over the years.

It lets you convert a portion of your homes equity into cash. If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works. Ad Reverse Mortgages Are More Common Than You Think.

Ad AAG is Americas 1 Reverse Mortgage Provider Has Educated Over 1 Million Retirees. As with a typical mortgage. Reverse Mortgages Have Helped Thousands of Retirees.

Web What Is a Reverse Mortgage. Web Reverse Mortgages allow people from the age of 60 to convert the equity in their property into cash for any worthwhile purpose. Homeowners 62 years and older who want to tap into their home equity and convert it into cash can do so with a.

If you are 62 years old or older and have considerable home equity you can borrow against the. Learn Why Retirees Trust Longbridge.

Michael Rodriguez Ceo And Broker Owner Platinum Capital Mortgage Linkedin

Hud Fha Reverse Mortgage For Seniors Hecm Hud Gov U S Department Of Housing And Urban Development Hud

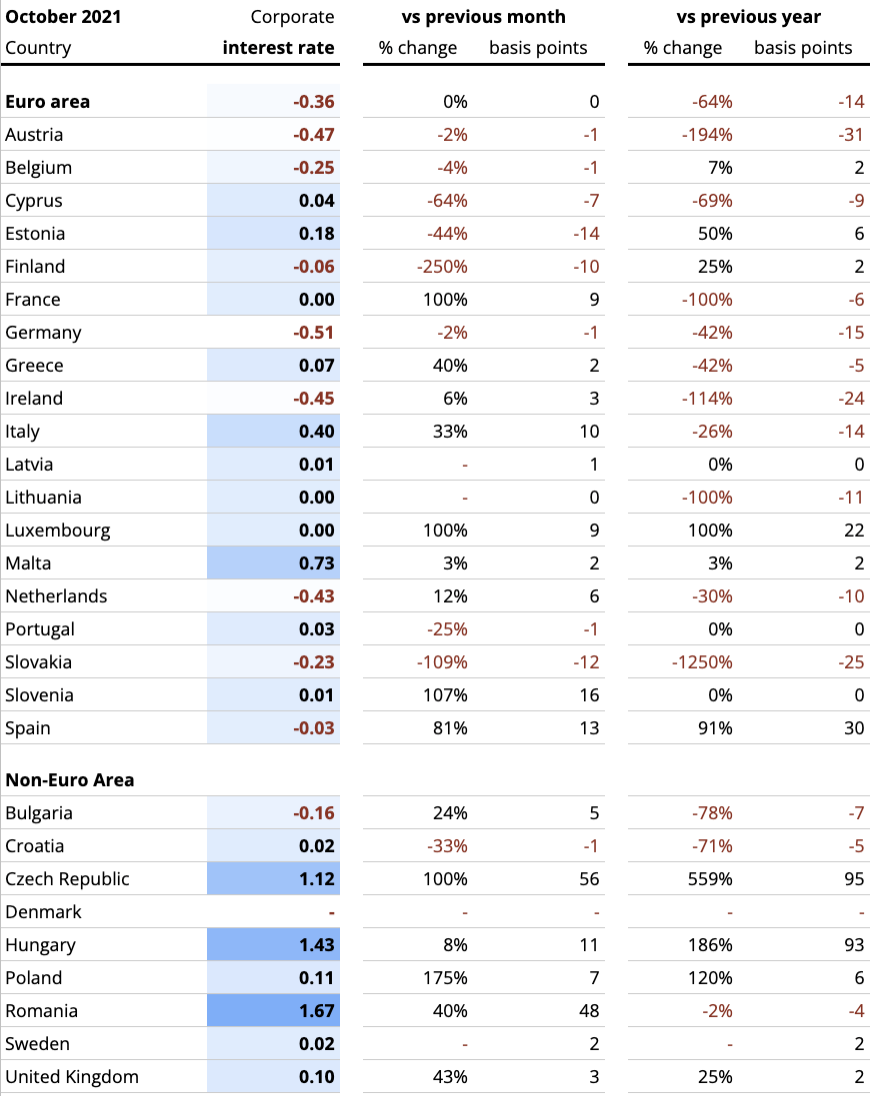

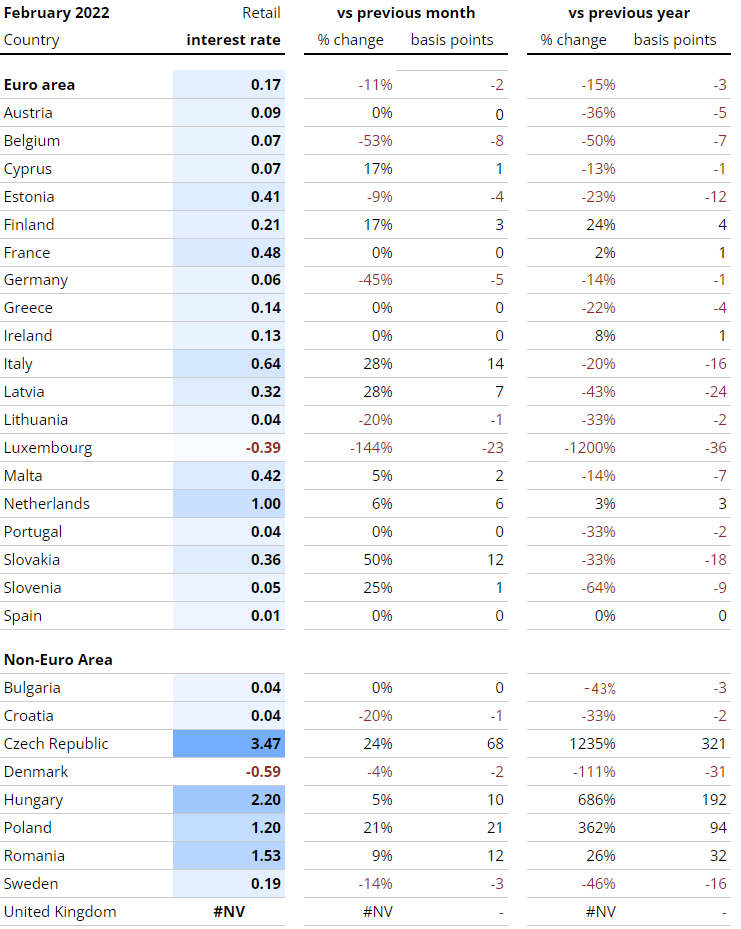

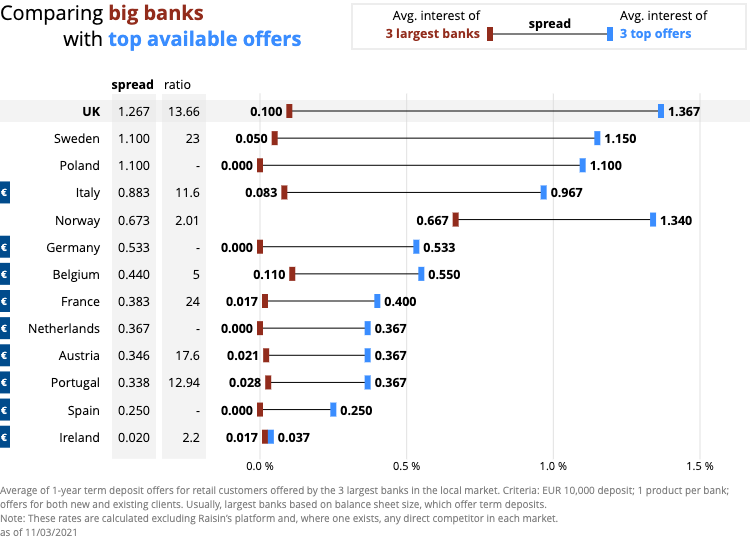

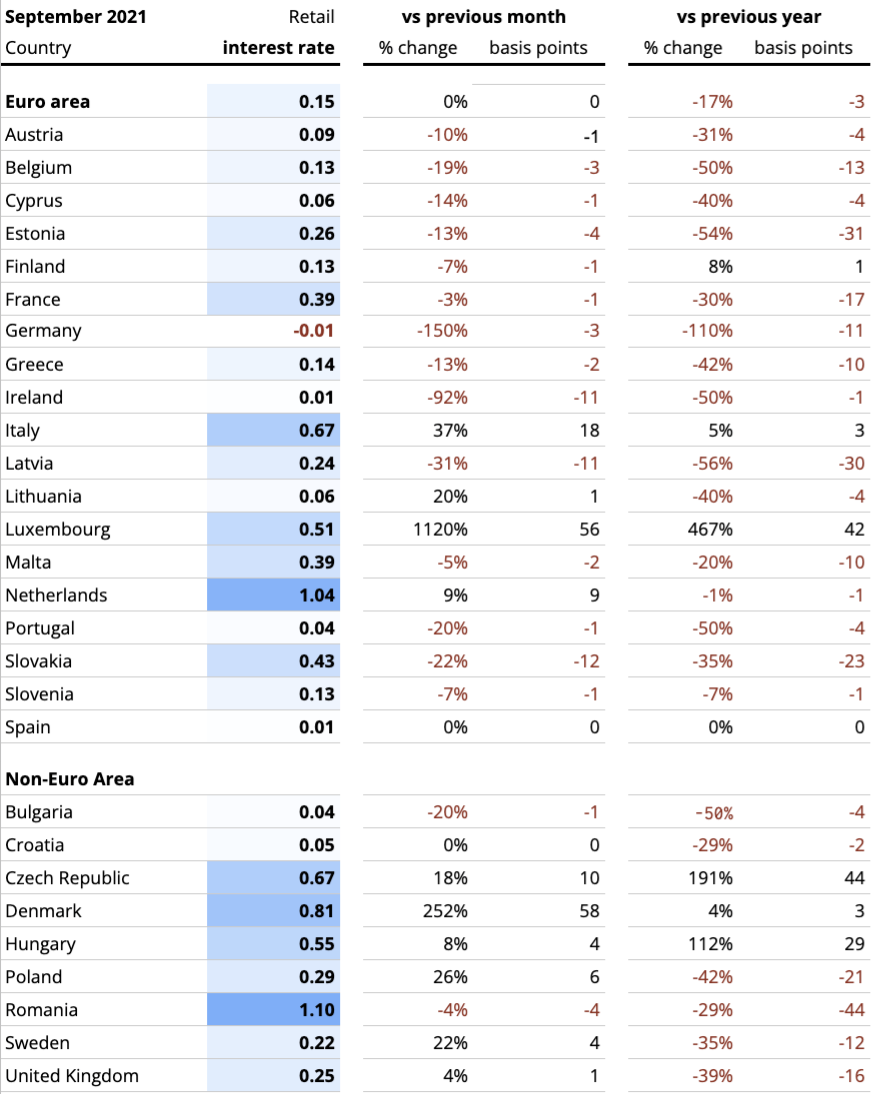

Interest Rates Explained By Raisin

A Guide To Reverse Mortgages For Older Adults

2800 May 11 2015 Pdf Master Of Business Administration Business

Why A Reverse Mortgage Is Better For Seniors Than A Home Equity Loan

Interest Rates Explained By Raisin

The New Math Of Reverse Mortgages For Retirees Wsj

Why A Reverse Mortgage Is Better For Seniors Than A Home Equity Loan

Compass Clock Fall Winter 2018 Publication

A Guide To Reverse Mortgages For Older Adults

Natalya Hill Senior Mortgage Loan Officer And Reverse Mortgage Planner Fairway Independent Mortgage Corporation Linkedin

Raisin S Interest Rate Tracker

Home Loans Business Lending Switch Finance Mortgage Brokers Gold Coast

Reverse Mortgage Requirements For Senior Homeowners Bankrate

Home Loans Business Lending Switch Finance Mortgage Brokers Gold Coast

Why A Reverse Mortgage Is Better For Seniors Than A Home Equity Loan